amazon flex quarterly taxes

You only need to do quarterly taxes if youre going to be above 1000 owed on your yearly return. Select Sign in with Amazon.

How Much Do Amazon Flex Drivers Make Gridwise

How do you get your Amazon Flex 1099 tax form.

. You can plan your week by reserving blocks in advance or picking them each day based on your availability. But instead of it taking you four hours to make all of your deliveries you managed to make them in three hours. Amazon Flex Drivers are considered 1099 non-employee workers which is a separate taxpayer status from the classic W-2 salaried employees who.

Driving for Amazon flex can be a good way to earn supplemental income. And Amazon pays you 25 an hour so 100 for the whole block. Drive a Fuel-Efficient Vehicle.

Report Inappropriate Content. The 1099-K form is your best friend. Gig Economy Masters Course.

If youre looking for a place to discuss DSP topics head over to. The IRS Form 1099-K you received is reported based on the information you provided during the US tax identity interview. Income taxes can be defined as the total amount of income tax expense for the given period.

You can find your 1099-NEC in Amazon Tax Central. Knowing your tax write offs can be a good way to keep that income in. By completing the Tax Interview in your seller account you will be providing Amazon the appropriate tax identity in the form of a W-9 or W-8BEN form.

Amazon Flex pays out earnings on a weekly basis for base pay and tips for the previous 7 days on every Wednesday. Taxpayers a TIN is. If you still cannot log into the Amazon Flex app.

Just claim the 1099 next year. The IRS Form 1099-K is generated from your Selling on Amazon. Businesses such as partnerships S corporations or LLCs that are taxed as.

Sign out of the Amazon Flex app. Tap Forgot password and follow the instructions to receive assistance. 12 tax write offs for Amazon Flex drivers.

If youre an Amazon seller living in the US then youre probably aware that tax time is coming up. Get to the Fulfillment Center Early. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

You may also need to file quarterly taxes. You are required to provide. With Amazon Flex you work only when you want to.

You must make quarterly estimated tax payments for the current. Amazon Flex quartly tax payments. If you have a W-2 job and do Amazon Flex for extra money you can increase your withholding at your main job instead of paying quarterly taxes.

Amazon Flex drivers can make between 18 and 25 per hour delivering packages. This subreddit is for Amazon Flex Delivery Partners to get help and discuss topics related to the Amazon Flex program. Increase Your Earnings.

Choose the blocks that fit your. The 1099-K is a sales reporting form that provides the IRS with your monthly and annual gross sales information. AMZN today announced financial results for its first quarter ended March 31 2020.

Our guide will help you get started. Take Advantage of Reserve Shifts. Only available in limited areas these deliveries start near your current location and last from 15.

Pickups from local stores in blocks of 2 to 4 hours. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. FilingPaying Self-Employment Taxes.

Amazon annualquarterly income taxes history and growth rate from 2010 to 2022. This subreddit is for Amazon Flex Delivery Partners to get. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400.

Write Your Gas and Repairs Off as a Business Expense.

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

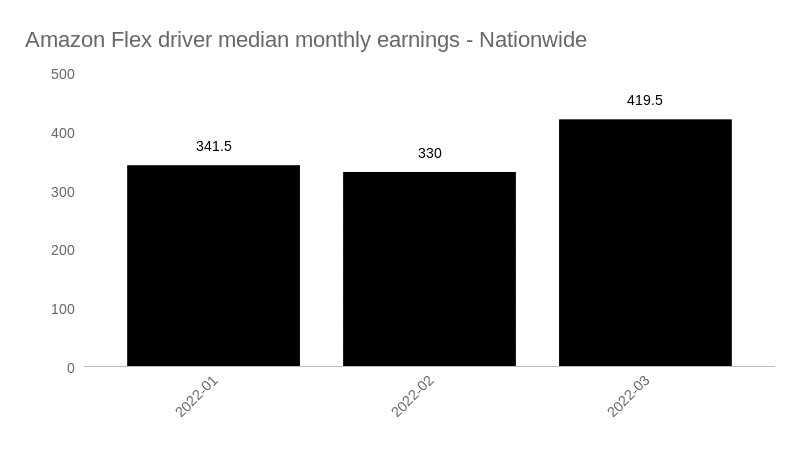

Amazon Flex Driver Pay Q1 2022 What Is Amazon Paying Their Drivers Gridwise

How Many Packages Does Amazon Flex Give You

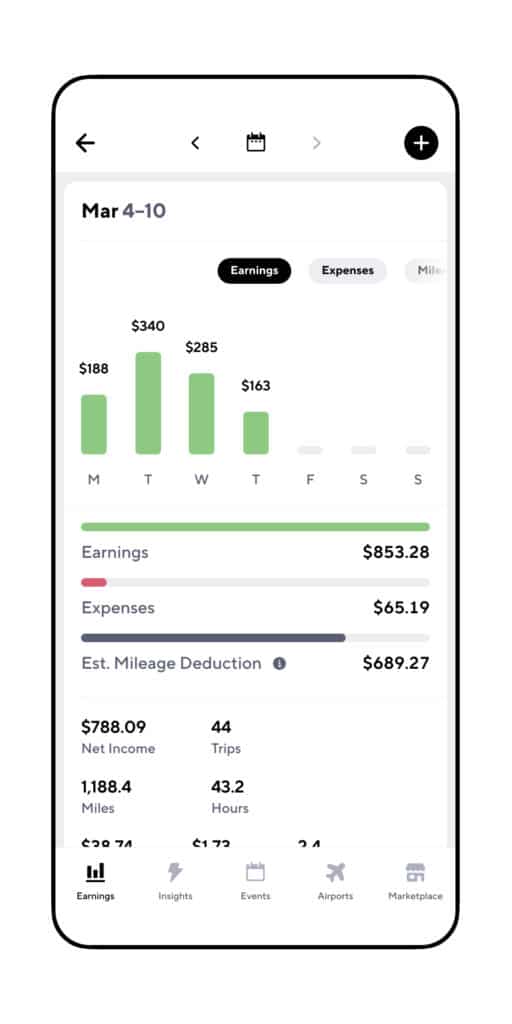

How Much Do Amazon Flex Drivers Make Gridwise

I Was An Amazon Delivery Driver What It S Like To Work In The Tech Giant S Citizen Package Brigade Geekwire

How To File Amazon Flex 1099 Taxes The Easy Way

Amazon Flex Driver Pay Q1 2022 What Is Amazon Paying Their Drivers Gridwise

Amazon Flex Filing Your Taxes Youtube

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

How To File Amazon Flex 1099 Taxes The Easy Way

How To Do Taxes For Amazon Flex Youtube

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

An Amazon Flex Delivery Driver In His 60s Making 120 A Day Shares What It S Like To Work Independently For The Retail Giant Warehouse Automation

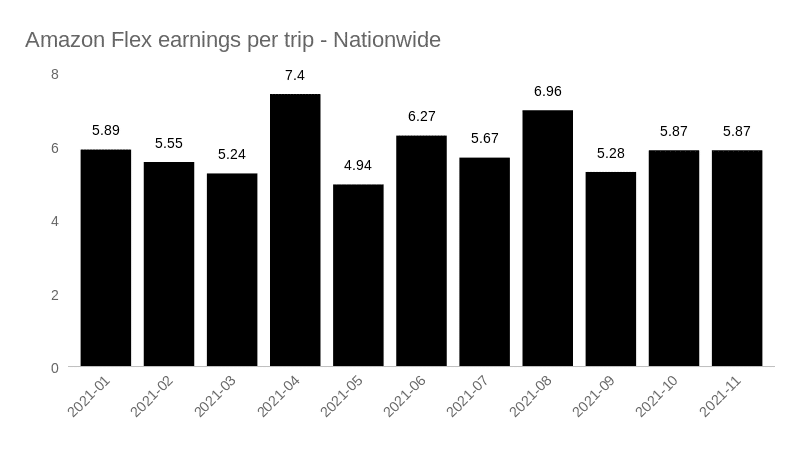

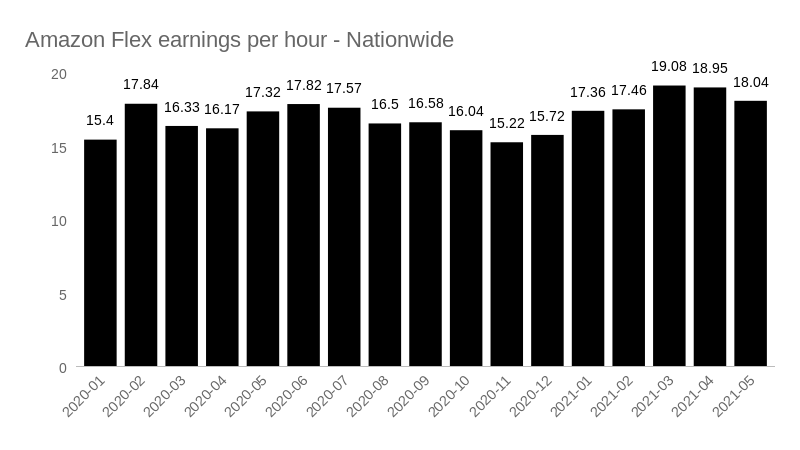

Earnings Recap Amazon Flex Driver Pay 2021 Gridwise

![]()

How Quickly Do I Get Paid Through Amazon Flex Money Pixels

Does Amazon Flex Take Out Taxes In 2022 Complete Guide

Drivers For Amazon Flex Can Wind Up Earning Less Than They Realize The Seattle Times